The much-anticipated release of Odoo v18 has brought a host of new features and enhancements tailored to businesses worldwide. For Australian companies, the standout update is the comprehensive localisation package. With Odoo’s commitment to catering to regional compliance, tax regulations, and business practices, the v18 Australian localisation ensures a seamless and efficient experience for businesses down under.

Here’s a closer look at the key features and improvements in Odoo v18’s Australian localisation:

1. Enhanced Tax Compliance with ATO Integration

One of the most significant updates is the deeper integration with the Australian Taxation Office (ATO). This includes:

- Automated BAS Reporting: Generate Business Activity Statements (BAS) with pre-filled data directly from Odoo, ensuring accuracy and saving time.

- GST Compliance: Simplified GST handling, including support for GST-free and input-taxed transactions, and seamless tracking of tax codes.

- Single Touch Payroll (STP) Phase 2: Odoo v18 supports the latest STP Phase 2 requirements, enabling businesses to report payroll data directly to the ATO with ease.

2. Australian Chart of Accounts

Odoo v18 comes preloaded with an Australian-specific chart of accounts that aligns with local accounting standards. This ensures:

- Faster setup for new businesses.

- Compliance with Australian Accounting Standards Board (AASB) regulations.

- Streamlined financial reporting tailored to Australian requirements.

3. Accounting Enhancements

Odoo v18 introduces significant updates to accounting for Australian businesses:

- Refined Tax Configuration: Australian taxes have been cleaned up to better suit the market, ensuring accuracy and compliance.

- TPAR Archiving: Taxable Payments Annual Report (TPAR) taxes are now archived by default, reducing clutter and simplifying reporting.

- Deferred GST (DGST) Management: Importers can now manage deferred GST entries with ease, including tracking and related monthly BAS closing.

- New BAS Payroll Sections: Added support for new "W" payroll sections in the BAS report, including a new flow for other amounts withheld (W3).

4. Bank Feeds and Reconciliation

Odoo v18 enhances banking operations with:

- Direct Bank Feeds: Integration with major Australian banks (e.g., Commonwealth Bank, ANZ, NAB, and Westpac) for real-time transaction imports.

- Reconciliation Automation: Improved algorithms for faster and more accurate reconciliation, saving hours of manual work.

5. Payroll Improvements

Payroll management has undergone a complete revamp in Odoo v18 to cater specifically to Australian businesses:

- Unified Salary Structure: All rules are now combined into a single salary structure, simplifying payroll configuration and management.

- Updated Tax Schedules: Includes the new 2024-2025 tax schedule rates, ensuring compliance with the latest regulations.

- STP Phase 2 and SuperStream Compliance: Necessary code has been added to submit official compliance tests, with compliance certification in process.

- Enhanced Input Types and Super Contributions: Other input types and super contributions have been completely revamped for better usability.

- YTD Balance Import: Easily import year-to-date balances for employees transitioning to Odoo Payroll.

- Termination Payments: Full implementation of ATO Tax Schedule 7 for unused leaves, with withholding variations applied as per variation notices.

- Ordinary Time Earnings Support: Manage both super guarantee and concessional super contributions effectively.

- Additional Features: Manage workplace giving, director fees, child support, and Medicare levy variations.

- Integrated Payroll Workflows: Payroll is now linked to Expenses and Accounting for streamlined operations.

- Batch Payments: Process payments directly from a payslip batch and reconcile them effortlessly.

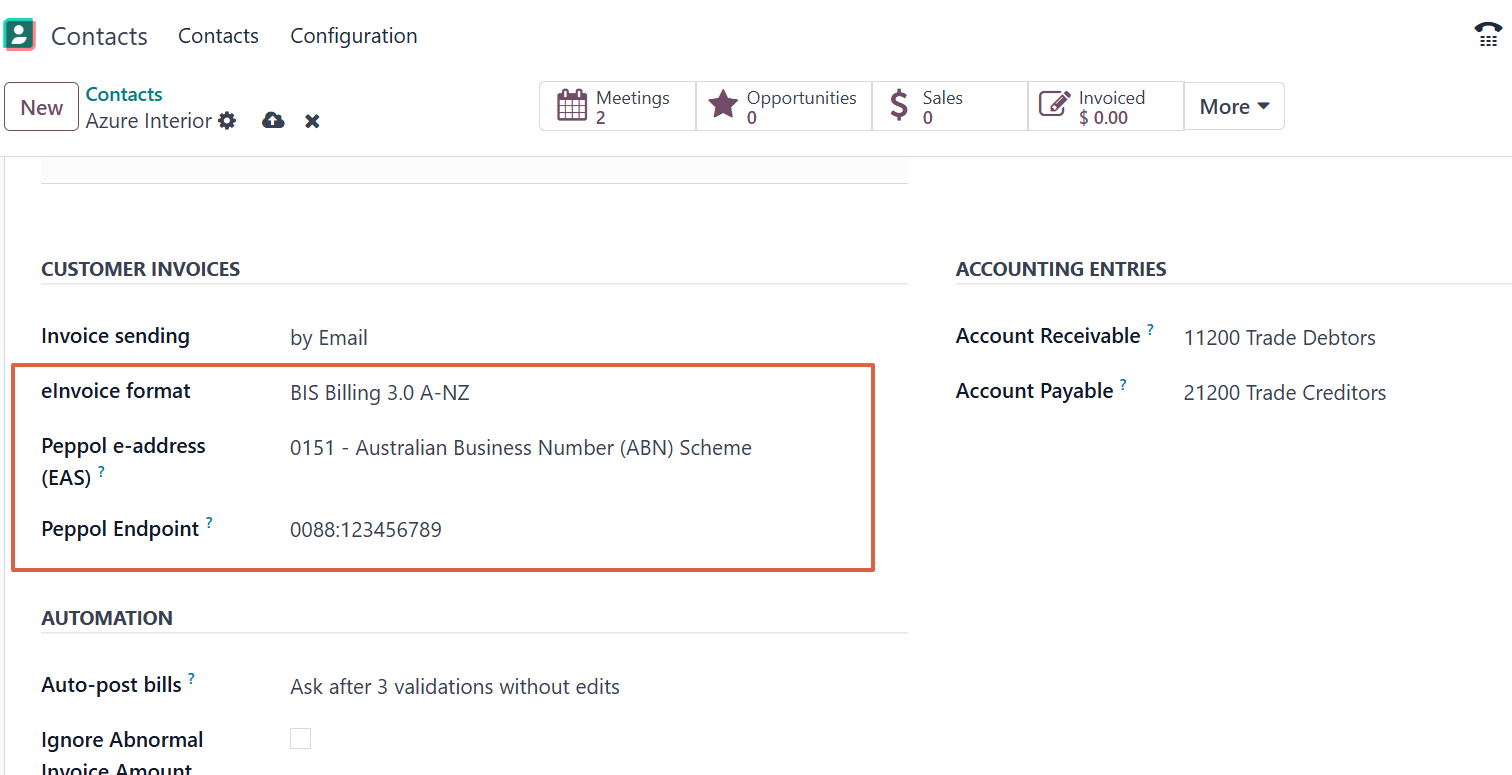

5. Localised E-Invoicing

Odoo v18 introduces support for PEPPOL e-invoicing, a growing standard in Australia for B2B and B2G transactions. This feature enables:

- Faster invoice processing.

- Reduced manual data entry.

- Compliance with government mandates for e-invoicing adoption.

6. Multi-Currency and FX Tools

With Australia’s global trade relationships, Odoo v18 includes:

- Real-time currency conversion rates.

- Improved tools for managing multi-currency transactions.

- Enhanced reporting for foreign exchange gains and losses.

7. Inventory and Supply Chain Updates

For businesses managing inventory and supply chains, Odoo v18 delivers:

- Landed Cost Calculations: Simplified calculations for import duties, freight, and other costs.

- Compliance with Australian Import/Export Standards: Support for HS codes and integration with Australian customs systems.

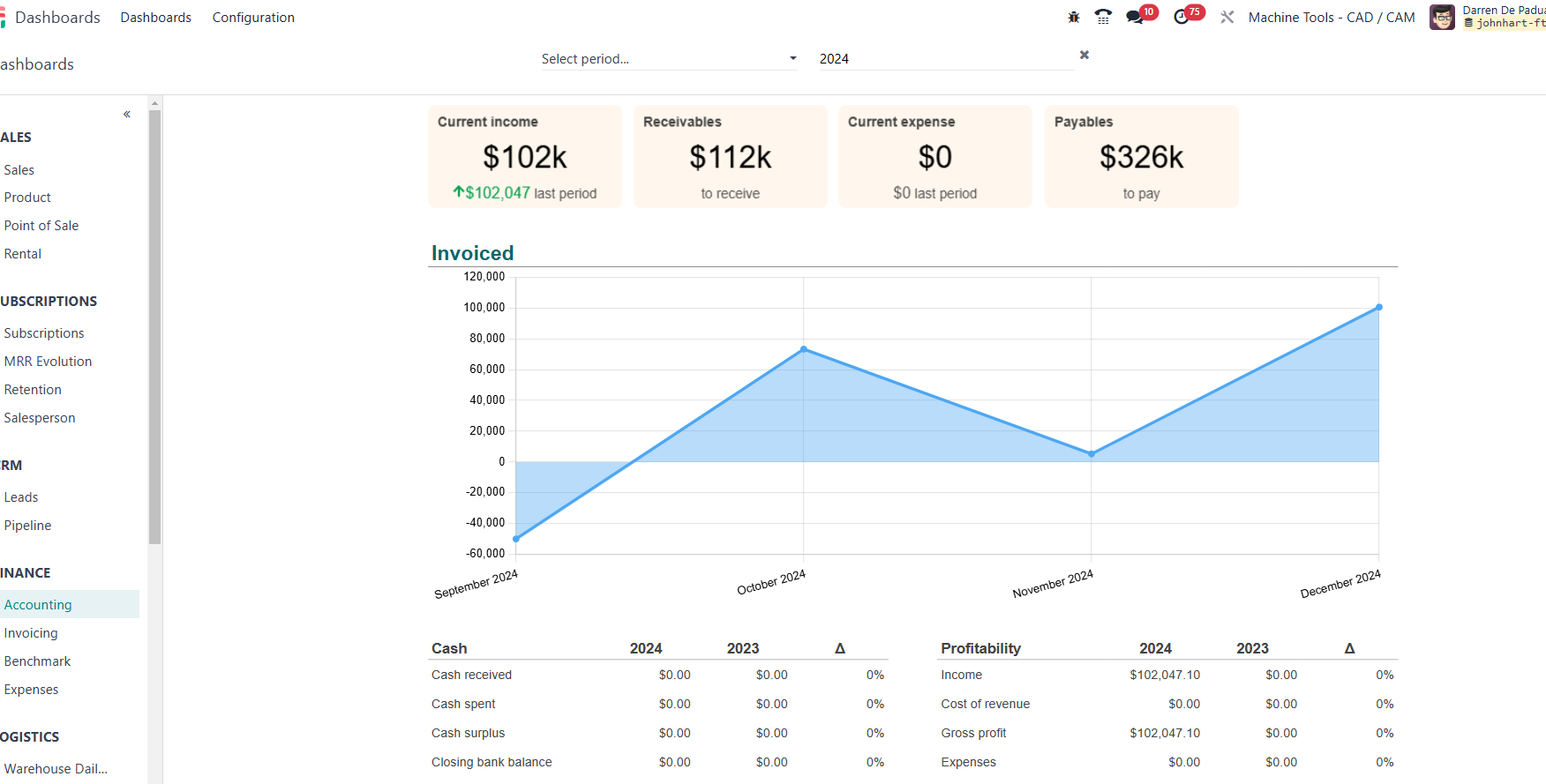

8. Usability Enhancements for Australian SMEs

Recognising the unique needs of small and medium-sized enterprises (SMEs) in Australia, Odoo v18 includes:

- Simplified onboarding for new users.

- Tailored dashboards for industries like retail, hospitality, and manufacturing.

- Enhanced mobile app functionality for on-the-go management.

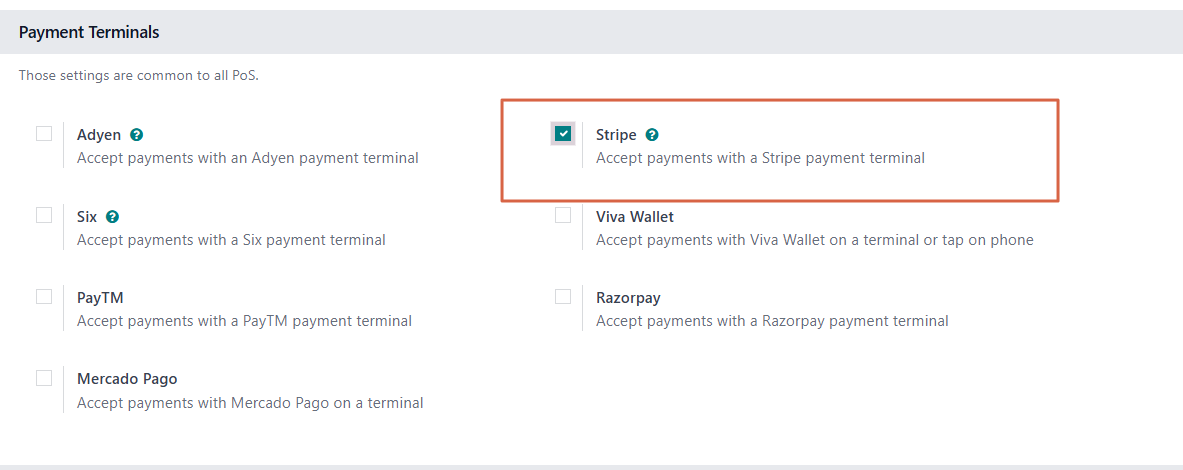

9. Industry-Specific Localisations

Odoo v18 caters to various Australian industries with specific features:

- Retail: POS systems with integrated EFTPOS support for Australian payment providers.

- Construction: Tools for managing progress claims and retention payments in compliance with local standards.

- Healthcare: Improved patient management and compliance with Australian healthcare regulations.

10. Buy Now, Pay Later Options

To cater to evolving customer payment preferences, Odoo v18 integrates with popular "Buy Now, Pay Later" (BNPL) services via Asiapay, enabling businesses to offer flexible payment plans to their customers. Key options include:

- Afterpay: A widely used BNPL service in Australia, allowing customers to split their payments into four interest-free installments.

- Zip Pay: Provides flexible payment options with no interest, giving customers the ability to pay later at their convenience.

- Klarna: Offers various payment plans, including installment options, enhancing the shopping experience for customers.

These integrations help businesses attract more customers by providing greater purchasing power and flexibility, leading to increased sales and customer satisfaction.

Why Odoo v18 is a Game-Changer for Australian Businesses

The Australian localisation in Odoo v18 demonstrates the platform’s commitment to meeting the specific needs of businesses operating in Australia. By integrating compliance, automation, and usability, Odoo v18 empowers businesses to focus on growth rather than administrative overhead.

Whether you’re a startup or an established enterprise, Odoo v18’s Australian localisation offers a robust and scalable solution tailored to your needs. From tax compliance to payroll management and beyond, this update ensures that Australian businesses can operate with confidence and efficiency.

Ready to Explore Odoo v18? If you’re looking to implement or upgrade to Odoo v18, our team of experts can help you navigate the process and customise the platform to suit your business requirements. Contact us today to get started!