Big news for Australian finance teams using Odoo!

Open Banking is now available directly inside Odoo thanks to a new integration with Basiq, Australia’s leading Consumer Data Right (CDR) platform.

This is a major step forward for automated bank feeds, smarter reconciliations, and real-time visibility of your cash position.

If you’ve ever battled with unreliable bank imports or manual uploads, this one’s for you.

🚀 What’s Actually New?

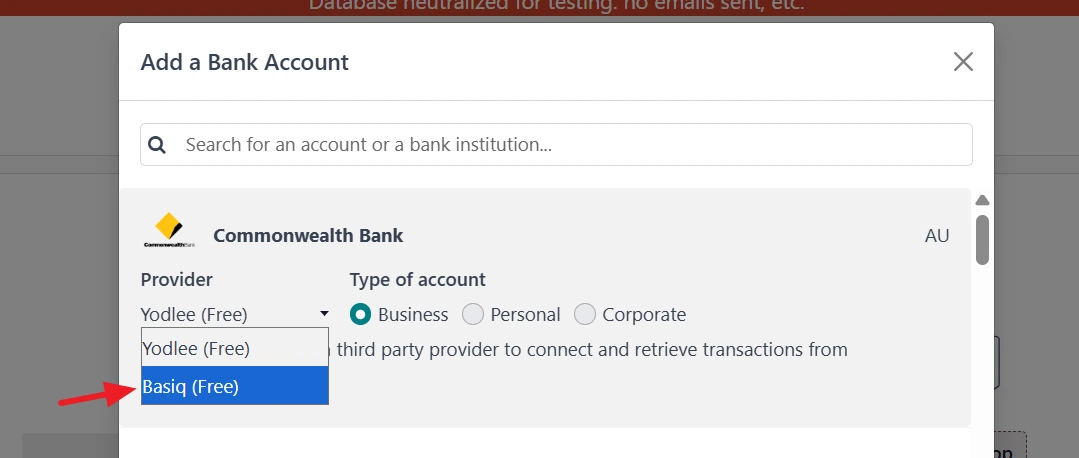

When setting up a bank account in Odoo, you can now choose Basiq as your sync provider.

Once connected, transactions flow securely from your bank into Odoo’s Accounting module – ready for reconciliation, matching rules, and reporting.

- Less spreadsheets.

- Less CSV juggling.

- More control.

Open Banking is much more well integrated when compared to the previous versions of Yodelee and Salt Edge - since the previous systems were based off a Web Scraping Mechanism.

Built for Australian Banks

Because Basiq operates under Australia’s Open Banking framework, it works with a large and growing list of local institutions, including:

Commonwealth Bank

National Australia Bank

ANZ

Westpac

Bank of Queensland

Bank Australia

Queensland Country Bank

BankSA

PayPal Australia

Auswide Bank

BankVic

CommSec

Great Southern Bank

Macquarie Bank

ANZ Plus

…and many more being added as the CDR ecosystem expands.

🔐 How Security & Permissions Work

To allow Basiq to retrieve data, the bank account holder must enable CDR data sharing with their bank during the connection process.

This means:

✅ You stay in control

✅ Access is permission based

✅ You can revoke it anytime

It’s modern, secure, and built specifically for Australia’s regulatory environment.

⚠️ A Few Things to Know

Like any new technology rollout, there are some early considerations:

Some banks may appear under multiple providers.

Certain institutions are exclusive to a single provider.

There are current limitations around some multi-currency or fintech-style accounts (for example Wise).

The good news?

This integration is already live across supported Odoo versions and will continue improving rapidly. Additional banks will also be added overtime.

💡 Why This Matters for Growing Businesses

For our clients across manufacturing, wholesale, field service, and retail, reliable bank feeds mean:

✔ Faster daily reconciliations

✔ Better cashflow visibility

✔ Cleaner month-end closes

✔ Less manual handling by finance teams

✔ More confidence in reporting

In short → finance becomes proactive instead of reactive.

🧠 The WMSSoft Take

We see this as a game changer. Open Banking is fundamentally Faster and more Accurate than Yodelee and Salt Edge which is a huge boost.

Anything that removes manual work from accounting and increases automation helps businesses scale without adding admin overhead.

That’s exactly what good ERP should do.

Ready to Connect Your Bank to Odoo?

Whether you are implementing Odoo for the first time or want to improve an existing system, we can help you:

Set up secure bank feeds

Optimise reconciliation rules

Automate allocations

Reduce month-end workload

Train your finance team

Talk to Australia’s Odoo specialists

If you want bank feeds working properly and your finance team loving Odoo, let’s make it happen.

Book a consultation